Yearly depreciation formula

It provides a couple different methods of depreciation. The numerator of the fraction is the current years net income.

Depreciation Calculation

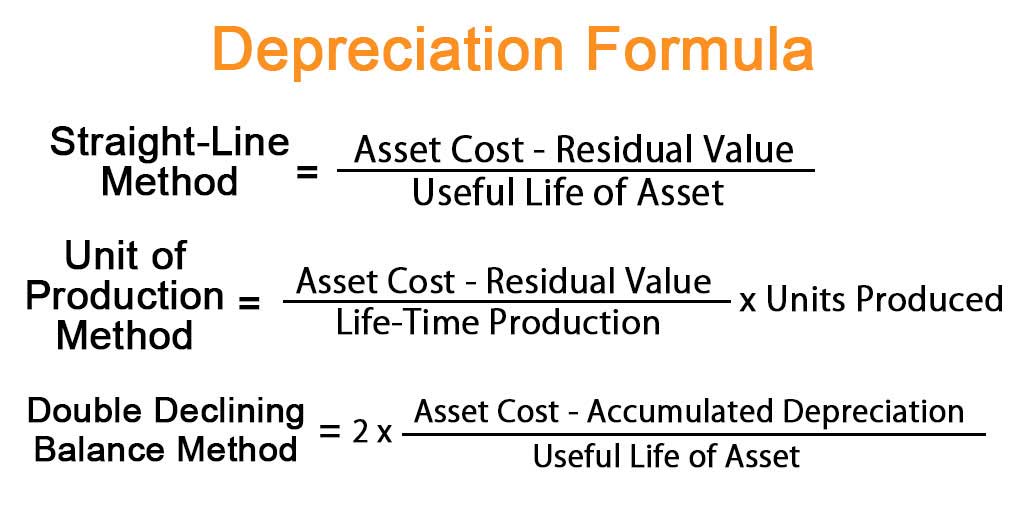

The straight-line method is the primary method for calculating.

. The SYD function calculates the sum - of - years digits depreciation and adds a fourth required argument per. For example the first-year. Current Year PPE Prior Year PPE CapEx Depreciation Since CapEx was input as a negative the CapEx will increase the PPE amount as intended otherwise the formula would.

Depreciable Value per Year is calculated as. Rate 1 20 100. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

Depreciable Value per Year Depreciation Rate purchase Price of. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Annual Depreciation Cost of Asset Net Scrap ValueUseful Life.

The syntax is SYD cost salvage life per with per defined as. Under this method we charge the depreciation. For every full year that a property is in service you would depreciate an equal amount.

First one can choose the straight line method of. Non-ACRS Rules Introduces Basic Concepts of Depreciation. Find a Dedicated Financial Advisor Now.

1800year Annual Depreciation Rate Annual. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. This depreciation calculator is for calculating the depreciation schedule of an asset.

The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. Depreciation Rate 1 Useful life 100. Depreciation Amount Straight-Line x Depreciable Basis.

If you enter a fixed yearly percentage application uses the following formula to calculate the depreciation amount. How to Calculate Accumulated Depreciation With Formulas and Examples 1. Annual Depreciation 10000-10005.

3636 each year as long as you continue to depreciate the property. Depreciation Amount Straight-Line x Depreciable Basis. Annual depreciation Depreciation factor x 1Lifespan x Remaining book value Of course to convert this from annual to monthly depreciation simply divide this result by 12.

Ad Do Your Investments Align with Your Goals. Under the income forecast method each years depreciation deduction is equal to the cost of the property multiplied by a fraction. Depreciation fracCost of the Asset Residual ValueLife of asset in hours x Actual hours used during the year.

Declining Balance Depreciation Double Entry Bookkeeping

Depreciation Rate Formula Examples How To Calculate

5 2 Ex 1 Financial Maths Depreciation Youtube

Accumulated Depreciation Definition Formula Calculation

Straight Line Depreciation Formula Guide To Calculate Depreciation

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Exponential Function Application Y Ab X Depreciation Of A Car Youtube

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Rate Formula Examples How To Calculate

Macrs Depreciation Calculator With Formula Nerd Counter

Exercise 6 5 Compound Depreciation Year 10 Mathematics

What Is Accumulated Depreciation How It Works And Why You Need It

A Complete Guide To Residual Value

Straight Line Depreciation Formula And Calculation Excel Template

How To Calculate Depreciation Expense

Double Declining Balance Method Of Depreciation Accounting Corner